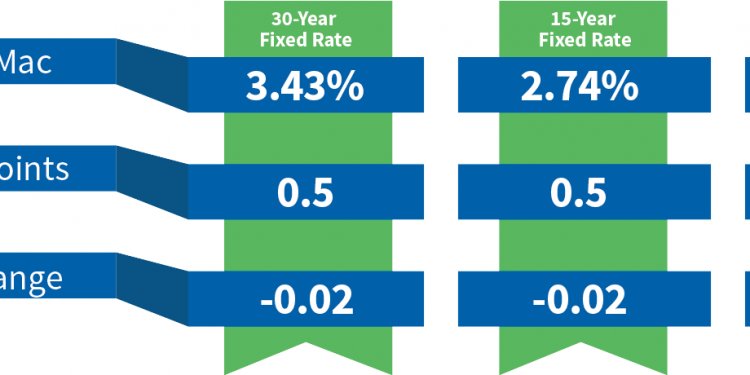

Current Mortgage Rates

The Brexit effect may be waning already. Since last week’s news that Britain was leaving the European Union, lenders have been aggressively discounting their mortgage rates. Tuesday was a split decision. Some major banks have already begun marking up their loan terms, while others were still adjusting their rates downward. The result: Average rates are incrementally lower Tuesday on 30- and 15-year fixed loans, while up a notch for 5/1 ARMs.

The Brexit effect may be waning already. Since last week’s news that Britain was leaving the European Union, lenders have been aggressively discounting their mortgage rates. Tuesday was a split decision. Some major banks have already begun marking up their loan terms, while others were still adjusting their rates downward. The result: Average rates are incrementally lower Tuesday on 30- and 15-year fixed loans, while up a notch for 5/1 ARMs.

However, this reverses a unanimous decision by lenders over the last two days to lower rates — and may signal the bottom for now.

The NerdWallet Mortgage Rate Index compiles annual percentage rates — lender interest rates plus fees — the most accurate way for consumers to compare rates. Here are Tuesday’s average rates for the most popular loan terms:

(Change from 6/27)

30-year fixed: 3.63% APR (-0.01)

15-year fixed: 3.02% APR (-0.01)

5/1 ARM: 3.32% APR (+0.01)

Wells Fargo, Chase and BOA mortgage rates

Three major components of the NerdWallet Mortgage Rate Index are leading lenders Wells Fargo, Chase and Bank of America. Their current purchase mortgage rates are:

NerdWallet daily mortgage rates are an average of the lowest published APR for each loan term offered by a sampling of major national lenders. Annual percentage rate quotes reflect an interest rate plus points, fees and other expenses, providing a more accurate view of the costs a borrower might pay.More from NerdWallet

Compare online mortgage refinance lenders