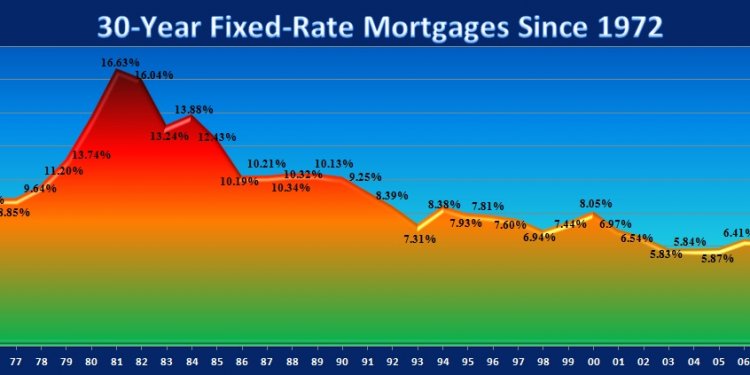

Bankrate mortgage Graph

Maybe the rent isn't too high. Or maybe it's way out of whack. It depends on your perspective. Specifically, it depends upon the period you look at.

Rents versus home prices

The Census Bureau collects quarterly data on asking prices for rents and asking prices for houses. When you look at the data going back to the beginning of 1988 in the graph below, you see that crazy spike in house prices during the housing boom and the abrupt fall in the crash. Meanwhile, rents continued their steady rise.

But let's look at the beginning and ending numbers:

- The median asking price for a house at the beginning of 1988 was $57, 000. 28 years later, the median asking price for a house was $144, 700. So during that time, asking prices increased by a factor of 2.5.

- The median asking price for rentals was $330 in 1988. Jeez - I paid more than that in the cheap city of El Paso! (But man, that was a sweet apartment that you could get only if you knew the previous renter.) At the beginning of 2016, the median asking price for rent was $870. So during that time, asking rents increased by a factor of 2.6.

For me, a 1985 college grad, rents and house prices kept pace with each other, from my 30-year perspective. Cool! I was born at the right time!

Millennial bummer

But, man, it's different if you graduated in, say, 2004. Home prices did their crazy ride, while rents marched ever upward - especially lately.

- The median asking price for a house in the 3rd quarter of 2004 was $113, 600; in the 1st quarter of this year, it was $144, 700. Asking prices increased by a factor of 1.3.

- During that time, asking prices for rents went from $619 to $870 - up by a factor of 1.4.

And what about what's happened since that high point in house prices in the second quarter of 2007?

- Median asking prices for houses went from $201, 500 to $144, 700 - down 28%.

- Median asking prices for rents went from $665 to $870 - up 31%.