Minority Home Loans

Photo: Katherine Feser, HC Staff

Photo: Katherine Feser, HC Staff

A study says the average home value in a ZIP code with at least one good school is 77 percent higher than the average in ZIP codes without any good schools.

Photo: Katherine Feser, HC StaffBlack applicants in Houston were more than twice as likely to be denied for mortgages than whites in 2015, according to recently released federal data.

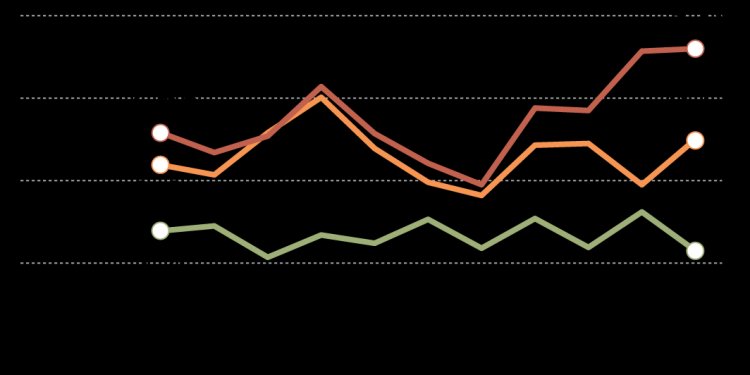

While overall access to home loans has improved in recent years, black and Hispanic borrowers continue to be denied mortgages at higher rates than whites and Asians here and nationwide, a recent report shows.

Last year, 22.4 percent of black applicants were denied conventional loans, according to data from the and presented in a That's down from 2010, when 30.5 percent of black applicants were denied. Among Hispanic applicants, 17.3 percent were denied in 2015, down from 25 percent in 2010.

In comparison, 10.4 percent of all conventional loan applications were denied in 2015, a drop from 14.2 percent in 2010.

Across the Houston region, denial rates for blacks and Hispanics were 17.7 percent and 14.6 percent, respectively, while white applicants were denied at a 6.9 percent rate. Asian applicants were denied at a 12 percent rate.

Overall in Houston, 9.9 percent of all loan applications were denied in 2015.

The homeownership gap between black and white households is as wide in 2016 as it has been for the past century, Zillow said.

"Owning a home is an important way for the middle class to build personal wealth. It's encouraging to see more black and Hispanic borrowers getting approved for mortgages, but there's still a lot of progress that needs to be made, " chief economist Svenja Gudell said in a statement.