Process of loan application

If you’re a parent of a dependent undergraduate student or if you’re someone planning to attend graduate school, you’ve probably heard of the PLUS loan. The Direct PLUS Loan is a federal loan program that’s available specifically for these two groups of people to help cover the remaining cost of attending school after all other financial aid has been applied. Below we’ll explain the requirements, application process, and some tips if you’re considering getting a PLUS loan.

If you’re a parent of a dependent undergraduate student or if you’re someone planning to attend graduate school, you’ve probably heard of the PLUS loan. The Direct PLUS Loan is a federal loan program that’s available specifically for these two groups of people to help cover the remaining cost of attending school after all other financial aid has been applied. Below we’ll explain the requirements, application process, and some tips if you’re considering getting a PLUS loan.

Requirements to Receive a PLUS Loan

No Adverse Credit History

A credit history is a summary of your financial strength, including your history of paying bills and your ability to repay future loans. To qualify for a PLUS loan, you cannot have an adverse credit history.

FAFSA Completion and PLUS loan Application

The student going to college (the child of the parent requesting the loan or the graduate/professional student) has to submit a FAFSA before beginning the PLUS loan application process.

Requirements for Parents:

You must be the biological, adoptive, or in some cases, stepparent of the dependent undergraduate student going to college. Your child must also be enrolled at least half-time at a school that participates in the Direct Loan Program. Unlike Direct Subsidized and Unsubsidized Loans; you, the parent, are responsible for repaying the PLUS loan.

Requirements for Graduate or Professional Students:

You must be enrolled at least half-time at a school that participates in the Direct Loan Program.

TIP for graduate and professional students:

If you’re eligible for Direct Unsubsidized Loans, you should borrow those loans before applying for PLUS. The interest rate is lower for Direct Loans.

How Much Money Can I Borrow?

The maximum PLUS loan amount is the cost of attendance (determined by the school) minus any other financial aid received. If you aren’t sure what your school’s cost of attendance is, contact your school’s financial aid office. If you want to see the average annual cost of a school, look it up on our College Scorecard.

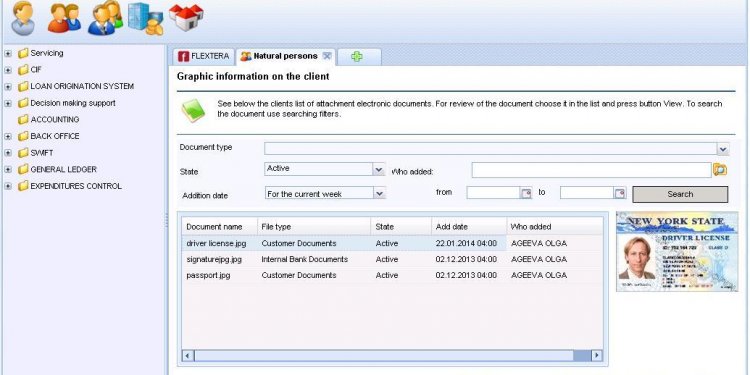

How to Apply for a PLUS Loan

In most cases, you’ll apply for a PLUS loan on StudentLoans.gov.

Some schools have a different application process, so check with your financial aid office to make sure you’re going to the right place.

1. Go to StudentLoans.gov

2. Log in using your FSA ID.

3. Select the type of PLUS loan you’re requesting, graduate student or parent.

Before making your selection, you should know the following:

- The award year the PLUS loan is for.

- Parents should have the student’s information, including their date of birth and Social Security number.

4. Fill out the “School & Loan Info” fields.

5. In the section that reads “Loan Amount Requested” you will have a few options.

- Selecting “I want to borrow the maximum amount for which I am eligible” will require you to select the loan period to which you’d like to apply the PLUS loan. This field may be different for each school.

- Selecting “I would like to specify a loan amount” will require you to type in the amount and the loan period start/end dates. If your request exceeds the amount you’re eligible for, the school will contact you.

- If you select “I do not know the amount I want to borrow. I will contact the school” then you should contact the school after your application has been approved, or the school may contact you.

6. Information about the PLUS loan borrower (the borrower is the parent of the undergraduate dependent student or the graduate/professional student):

- Permanent address.

- Mailing address.

- Employer information if the borrower is employed.

7. Credit Check and Adverse Credit History

PLUS loans are the only type of federal student loan that require a credit check. If you are found to have adverse credit history during the application process, you still have options.