Interest rates on 10 year fixed mortgage

These loans are ‘portable’ – you can take them with you should you wish to change property. Photograph: Matt Cardy/Getty Images

These loans are ‘portable’ – you can take them with you should you wish to change property. Photograph: Matt Cardy/Getty Images

Ten years … it that too long to tie yourself into a mortgage deal? Lenders don’t seem to think so and have started to launch decade-long fixed-rate deals with “extraordinary” interest rates of less than 4%.

Last week the Nationwide building society announced a 10-year fixed-rate mortgage available to anyone with at least a 15% deposit to put down on their chosen property, or the equivalent equity in their home if they are remortgaging.

At a 70% loan to value (LTV), the society will charge a rate of 3.49% and a £999 fee; at up to 75% LTV it charges 3.94% and up to an 85% LTV the rate is 4.54%. Existing customers get a “loyalty discount” of 0.1% off all the above rates and first-time buyers get a fee reduction to £499.

Nationwide is not the only one to offer tempting deals for longer. The West Brom building society has cut the rate on its 10-year fix to 3.99% on a maximum LTV of 75% with a £199 fee; Barclays (through lending arm the Woolwich) has launched a 3.49% 10-year fix on a LTV of up to 60% with a £999 fee.

“We’ve seen significant amounts of customers favouring longer-term fixed-rate mortgages this year, ” says Richard Napier, Nationwide’s director of mortgages and savings. “In September almost a quarter of new reservations were for our five-year fixed-rate products. Prudent customers want to protect themselves against payment increases and so the introduction of a new 10-year fixed-rate deal is a logical addition.”

Andrew Montlake of mortgage brokers Coreco says that an interest rate of under 3.5% for a 10-year fixed-rate deal is “extraordinary”. “This is really the first time that lenders have been able to price 10-year fixes so competitively, ” he says. “With rates this low and the fact that the loans are portable [can be moved between properties] they will undoubtedly tempt more borrowers.”

Mark Harris, chief executive of mortgage broker SPF Private Clients agrees: “The mortgage-rate war is extending to longer-term fixes with some astonishingly cheap rates, ” he says. “Borrowers must ensure they are happy about fixing for 10 years, however, because there are hefty early repayment charges if you want to get out of the mortgage before the end of the fixed term.”

Try to get out of the Nationwide loan early, for example, and you will pay 7% of the outstanding loan in the first five years and a smaller fee in any of the following five years.

Montlake points to Newcastle building society, which is rare in offering a 10-year fix where the redemption penalties are only for five years of the loan, although its rate is a much higher 4.49%.

“Most clients we see cannot picture themselves beyond five years, which is why 10-year mortgages are often too much of a stretch, ” he says. “If more lenders offered a shorter period of early redemption penalties, many more borrowers would take a 10-year fix.”

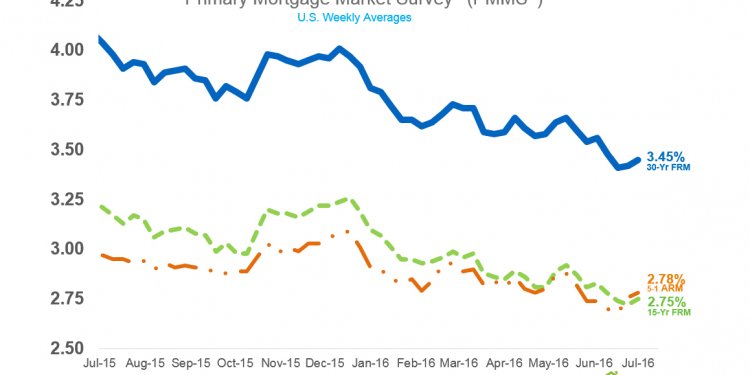

The new mortgage deals come during a price war between lenders. The average two-year fix (for those with a 25% deposit) is now 2.46%, according to the Bank of England, 1% below the average rate two years ago. For borrowers with a 10% deposit, the rates available for two-year fixes are the lowest on record.

And it is fixed rates that are popular as borrowers, worried about rising interest rates, opt for security. Data from the Council of Mortgage Lenders suggests that around 90% of new mortgages were contracted on fixed rates in recent months, up from 67% two years ago.

And earlier this month Nationwide announced the lowest ever fixed-rate mortgage in its history. The new two-year fixed-rate deal is available up to 60% LTV, has a rate of 1.84% for new mortgage customers, and 1.74% for existing mortgage customers. It comes with a £999 product fee, reduced to £499 for first-time buyers.

Elsewhere in the market, HSBC has a two-year fixed rate for the same LTV with a lower rate of 1.49% but with a £1, 999 fee. For five-year fixed rates, Accord (a broker-only lender) has a rate of 2.59% and a fee of £845 on a maximum LTV of 65%. For those people wanting to borrow a higher LTV with a lower fee, the Coventry building society launched a five-year fix last week for a LTV of up to 80% with a £199 fee at a rate of 3.29%.