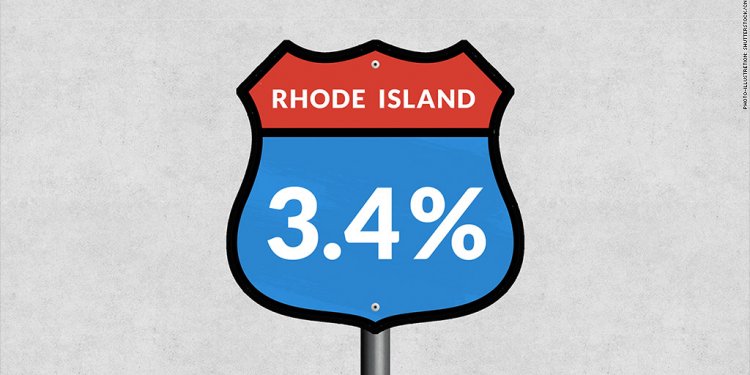

Mortgage rates by State

If you're thinking about buying a home sometime soon, you've got one big thing working in your favor: low interest rates. Mortgage rates are at a record low, making the price you pay for your home cheaper overall, GOBankingRates explains. They checked out average rates across the country and put together a list of best and worst states for home financing.

If you're thinking about buying a home sometime soon, you've got one big thing working in your favor: low interest rates. Mortgage rates are at a record low, making the price you pay for your home cheaper overall, GOBankingRates explains. They checked out average rates across the country and put together a list of best and worst states for home financing.

GOBankingRates explains how rates have changed in the past few decades:

According to Freddie Mac, average mortgage rates reached a high of 16.63% in 1981, eventually dipping to pre-recession rates of 6.41% in 2006. At that percentage, total interest paid over the life of a loan (at the current median home price of $215, 000) would amount to $215, 718, with monthly payments of $1, 301. Compare that to the 2013 average of 3.98%: Total interest would be almost halved, at $122, 902, and the monthly payments would be more than $250 cheaper.

The site partnered with RateWatch and surveyed average mortgage rates across the country. They ranked the 10 most and least affordable states for taking out a home loan.