5 year Refinance mortgage Rates

ARM Mortgage Rates Average 2.99%

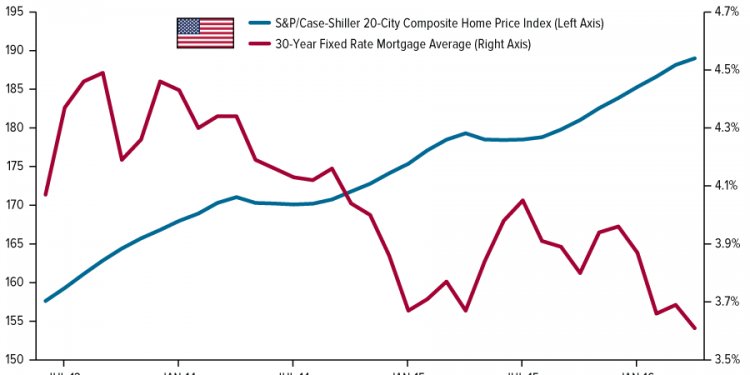

According to Freddie Mac's most recent mortgage rate survey, 30-year fixed rate mortgages currently average 3.93 percent nationwide; and, 15-year fixed rate mortgages average 3.16%.

However, for the right borrower, the 5-year adjustable-rate mortgage (ARM) looks excellent.

The popular ARM loan now averages 2.93%.

Mortgage Rates: 4.25 Points Beneath Averages

Each week, government-backed Freddie Mac surveys a network of more than 100 lenders to find the "national mortgage rate" for prime borrowers.

"Prime" borrowers are defined as those having a credit score of 740 of better; verifiable income with acceptable debt-to-income ratios; and a loan-to-value of eighty percent or lower.

The most recent Freddie Mac survey shows the average 30-year mortgage rate at 3.93%; and the average 15-year mortgage rate at 3.16 percent. Rates are available to borrowers agreeable to paying 0.6 and 0.5 discount points, respectively.

As compared to history, these rates are remarkable.

Freddie Mac has tracked mortgage rate data since 1971. Throughout those 44 years, the 30-year mortgage rate has averaged near 8.375 percent. Rates today are less than half of that.

Borrowers are required to pay far fewer points, too.

Historically, banks have assessed 1.3 discount points per loan to U.S. borrowers. Today, those costs are down close to two-thirds.

Borrowers are saving big money.

Historically, it's required $375, 000 to pay a $100, 000, 30-year mortgage to zero. Today, that cost is $171, 000.

Today's homeowners pay 55% less to own their home outright.

Today's ARM Mortgage Rates Drop Below 3%

Along with fixed-rate mortgage rates, adjustable-rate mortgage rates are near new lows, too.

Freddie Mac's weekly mortgage rate survey puts the 5-year adjustable-rate mortgage at 2.99% nationwide with just 0.4 discount points required at closing.

Today's ARMs are governed by strict rules which determine by how much rates can change each year; and, which place limits to how high your adjustable-rate mortgage rate can go in any given year.

However, you'll still want to know to what you're agreeing.

ARMs work like this.

For some fixed number of years - usually between three and ten - the mortgage rates for an ARM cannot change. With a 5-year ARM, this initial period is five years. With a 7-year ARM, the period is seven years.

Then, after the initial, fixed number of years have passed, the ARM mortgage rate can change but only based on a pre-determined formula.

Most ARMs are limited to interest rate changes of no more than 2% per year, save for their first annual adjustment.

For example, at its first adjustment, a 5-year ARM is typically limited to a range of ±5 percentage points from the original "teaser" rate; and, a 7-year ARM is typically limited to a range of ±6 percentage points.

This first adjustment is the only time an ARM's rate can move by such large amounts.

Beginning 12 months after the initial adjustment, and repeating every 12 months during the loan's 30 years, ARM mortgage rates are subject to adjust again, but limited to just ±2 percentage points in either direction.

Your mortgage rate can never move more than 2 percentage points in a year - up or down.

In addition, your rate is "capped".

ARM mortgage rates can't move infinitely higher. ARM mortgage rates are restricted by "collars", which are typically ±5% or ±6% from the loan's starter rate.

The "rules of the ARM" protect borrowers. Payments can't climb at the discretion of the bank; nor can rates changes based on some arbitrary factor.

ARMs can only adjust according to prescribed rules.

Are ARMs Better Than Fixed Rate Mortgages?

In today's market, the mortgage rate of a 5-year ARM is a 94 basis points (0.94%) lower than a comparable 30-year fixed. Rates for the 5-year ARM average 2.99% and rates for the 30-year loan average 3.93%.

Because its rates are lower, 5-year ARMs save $52 per $100, 000 borrowed at today's mortgage rates.

Getting access to "cheaper payments", though, should not be the reason you choose an adjustable-rate mortgage over a fixed-rate one.

There are 3 bona fide scenarios in which a homeowner should consider an ARM over a 30-year fixed.

The first scenario is one in which the homeowner intends to move or sell within the next 5-7 years.

For homeowners not in need of a "long-term" loan, an adjustable-rate mortgage can be an excellent way forward. There's no need to pay more for the fixed-rate nature of a 30-year fixed rate loan when a 5-year ARM can suffice.

This scenario can be tricky, however, because there's no guarantee of what mortgage rates will be in the future when you decide to refinance; or whether you'll qualify for a loan when the time comes to refinance.

Lastly, consider a adjustable-rate mortgage if you're comfortable with the notion that your mortgage rate may change, and you're budgeted to make larger payments.

Payments for an ARM won't leap uncontrollably, but any increase to your payment can be an uncomfortable one.

What Are Today's Mortgage Rates?

Current mortgage rates are low. Fixed-rate mortgage rates are below four percent and adjustable-rate mortgage rates are in the 2s. It's a good time to compare your mortgage options and see what you can save.

Get today's live mortgage rates now. Your social security number is not required to get started, and all quotes come with access to your live mortgage credit scores.

The information contained on The Mortgage Reports website is for informational purposes only and is not an advertisement for products offered by Full Beaker. The views and opinions expressed herein are those of the author and do not reflect the policy or position of Full Beaker, its officers, parent, or affiliates.