30 Yr fixed Jumbo mortgage Rates

Fannie Mae and Freddie Mac set jumbo mortgage loan purchase limits.

Fannie Mae and Freddie Mac set jumbo mortgage loan purchase limits.

Most every home buyer in this country uses a mortgage loan to purchase a home. In general, a mortgage falls into two broad categories known as "conforming" and "non-conforming, " or jumbo, mortgages. Jumbo mortgages are non-conforming because they exceed established lending limits. Two government-sponsored enterprises, Fannie Mae and Freddie Mac, determine those limits. These companies purchase most mortgages from lenders, and they won't usually buy loans that don't conform to their limits.

Features

A 30-year fixed jumbo mortgage is a home loan that will be repaid over 30 years at a fixed interest rate. The amount of a jumbo mortgage will exceed the current Fannie Mae and Freddy Mac loan purchase limit of $417, 000 for a single-family home, as of July 2010. Most such jumbo mortgages also require 20 percent down payments and stronger income documentation. In addition, your monthly payment on a jumbo loan likely won't be permitted to exceed 38 percent of your pre-tax income.

Considerations

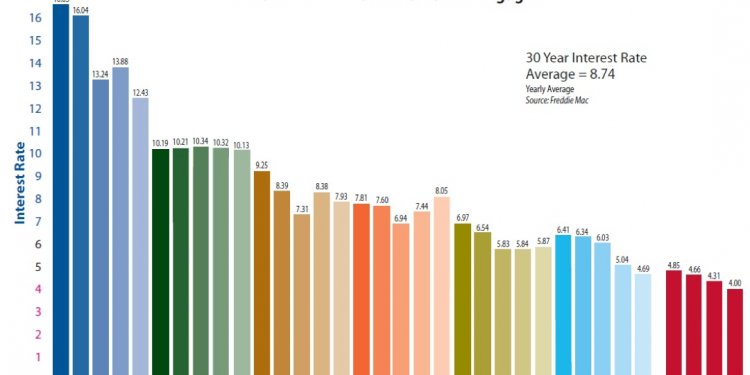

Jumbo mortgages also usually come with higher interest rates. These can run from .25 percent to as much as 1.5 percent above the average conforming mortgage's rate. In many cases, lenders also require two separate home appraisals for a jumbo mortgage, for side-by-side comparisons. Properties bought using jumbo home loans are expensive and are often very large; obtaining two independent appraisals ensures a more objective value.

Risks

For lenders, jumbo mortgages carry a few risks because these loans are used to buy properties that may be difficult to sell quickly at full price in the event of default. According to Business Insider, June 2010, default rates for jumbo mortgages are nearly twice the rate of conforming mortgages. Because these loans are for expensive homes, the available prospective buyer pool is limited.

Geography

Certain areas of the country feature home prices well north of Fannie Mae and Freddie Mac home loan purchase limits. San Francisco is one such example. Even a modestly sized home can easily exceed $417, 000. High local housing prices can force buyers into a jumbo mortgage for properties that aren't very large or well-appointed. Fortunately for San Francisco and other expensive real estate markets, the limit for a single-family home is set at $729, 750, according to Fannie Mae.

Significance

For a time after the markets tanked so badly in October 2008, jumbo mortgage interest rates rose steeply. However, the Wall Street Journal observed, in July 2010, that current rates for these loans are now at their lowest since 2003. Applications also seem to be on the rise, and some of the country's largest lenders are offering jumbo mortgages starting in the 5 percent range. You'll need to have outstanding credit, though, to get one of them.