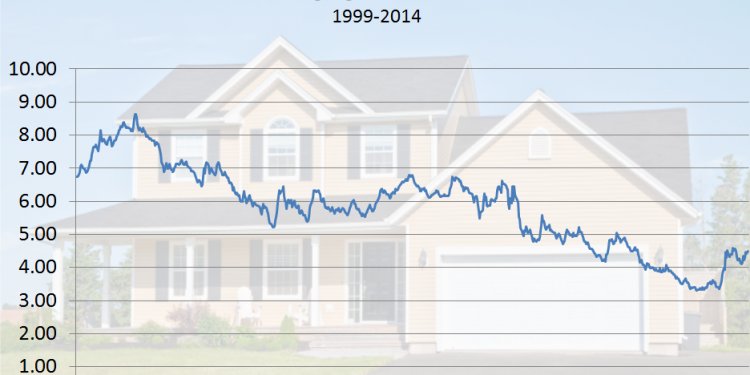

VA 30 Yr fixed mortgage Rates

A month back, I wrote about some pros and cons of the 30-year fixed. It’s a very popular mortgage, that 30-year, so there clearly has to be quite a few pros for the loan. And they’re well deserved. Like I said in the previous article, the 30-year has pretty much always been the most popular mortgage for our clients in our 28-year history.

A month back, I wrote about some pros and cons of the 30-year fixed. It’s a very popular mortgage, that 30-year, so there clearly has to be quite a few pros for the loan. And they’re well deserved. Like I said in the previous article, the 30-year has pretty much always been the most popular mortgage for our clients in our 28-year history.

So what about the 15-year fixed? Why has it been the best choice for millions of Americans over the past several years? Why do I have a 15-year fixed VA loan? And why did I have a 30-year fixed loan at one time? Let’s find out.

“Why would anyone get a 15-year fixed?” I asked her. Here’s what she said:

Interestingly enough, the 15-year mortgage is actually good for anyone who has an interest in paying less money for their home overall, as well as becoming payment free by a certain time. Over the past few years, we’ve seen people be less concerned with having the biggest and the best when it means overextending themselves, and more concerned with being financially stable. For many people, the 15-year mortgage is the new black; not having to resort to a payment for twice as long and paying tens of thousands of dollars more in interest to get a house you want is seen as an indicator of that stability.”

Wow, that was a mouthful. In other words, one of the pros of the 15-year fixed is that you pay less interest. Hint: that’s why I got one. Let’s dig in to all the pros.

Pros of the 15-Year Fixed Loan

- Pay off your loan faster. That means you own your home outright in half the years it takes if you choose a 30 year. I’ve never owned a home outright, but it must be a good feeling. I’ll let you know in 13 ½ years when my home is paid off.

- A lower interest rate. It’s pretty simple. The shorter time you borrow money, the lower your rate. So, a 15-year will always be lower than a 30-year. And that means that you’re paying a lower rate for the entire time you have your mortgage.

- You’ll be able to plan ahead for life changes. If you know something is coming in the future (children going to college, retirement, etc.), not having a mortgage during these changes could be a great plus for your budget. That money you pay on your mortgage might just come in handy for college expenses or for supplementing reduced income because of retirement. Knowing your mortgage payment will end is a great tool for planning ahead.

Cons of the 15-Year Fixed Loan

- Higher monthly payment. When you choose a 15-year, you’re locked into a higher payment compared to a 30-year or an ARM, with no exceptions. You must make that payment each month, regardless of your financial situation. People need to be very sure they can always make the monthly payment. If they can, it’s a great choice. If there’s any question, a longer term with a lower minimum payment might be better for them.

- Longer term than many shorter loans. If you can afford the higher payment, why settle for a 15 year when a 10 year or an 8 year is available? Remember, the shorter the term, the less interest you pay and lower rate you’ll enjoy. So for folks with cash and no financial worries, an 8-year fixed-rate YOURgage will save them thousands in interest compared to the traditional 15-year.

- Qualify for less home. Because the monthly payments on the 15 year are higher, you’ll qualify for less mortgage value and therefore home value. The longer the term, the lower the monthly payment and the higher the home value that a person can afford based on their income.

As you can see, from my perspective, there are more pros than cons for the 15-year. I’m extremely happy with mine. And right around the time I need to get serious about my daughter’s college, my mortgage will be paid and clear. Like I said earlier, that sure will be a good feeling.

Whether or not a 15-year is best for you is something you should discuss with a mortgage professional. Make sure they understand your goals and financial concerns before they recommend the best mortgage. You want to pay the least amount of interest, of course. However, you don’t want to be stuck with a payment you might not be able to afford.