Fixed Interest Rate

There is no right answer to this question—it depends on your personal budget, your term, and your tolerance for risk when rates change.

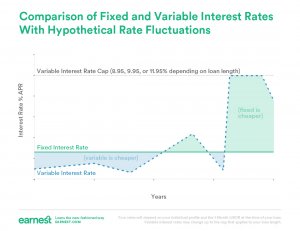

The most simplified way to think about it is this: variable loans can be cheaper—but your minimum payment will change over time—while fixed loans generally cost a little more and your minimum payment will never change.

| Variable rates are better when: | Fixed rates are better when: |

|---|---|

| You have a shorter loan term, which limits the chances for rates to change. | You have a longer loan term, and you don’t want to be affected by moving rates. |

| You can handle an increased minimum payment. | You don’t want your minimum payment to increase. |

| You believe interest rates will decrease or stay flat in the near future. | You believe interest rates will increase in the future and you want to lock in a rate now. |

What is a fixed-rate loan?

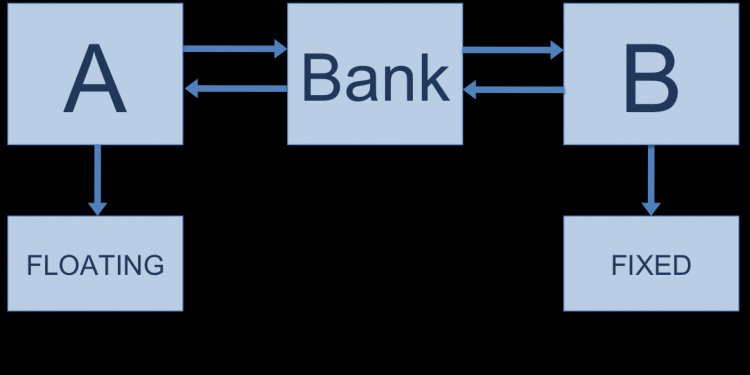

A fixed-rate loan means that your minimum payment will never change over the life of the loan—you lock in your terms when your sign the agreement, and even if interest rates go up, your APR does not.

One reason borrowers, especially those with long-term loans, like fixed rate loans is that they provide a kind of “interest rate insurance”—they cost a little more, but that premium protects you against price changes down the road.

What is a variable-rate loan?

A variable rate may start out lower than a fixed rate, but it will fluctuate over the life of the loan as its underlying reference rate changes. This means your minimum payment will change as rates change.

The reference rate Earnest uses is 1-month LIBOR.1 At Earnest, we update the rate monthly, according to figures published in the Wall Street Journal.

Some borrowers prefer variable rates because they don’t want to pay a premium for the “interest rate insurance”—they are making a kind of bet that rates won’t rise significantly during their loan term, which is why these tend to be better for shorter terms.

A final thing about variable rates to keep mind: There is no limit to how much the reference rate can rise or fall in any one year, but each loan does have a maximum APR. At Earnest, any variable loan that has a term of 10 years or less has a lifetime cap of 8.95% For any loan term of more than 10 years and up to 15 years, it’s 9.95%. Any term longer than 15 years is capped at 11.95% subject to state availability.