Mortgages fixed interest rate

By Lisa Smith

By Lisa Smith

A fixed-rate mortgage is a loan that charges a set rate of interest that does not change throughout the life of the loan. It is the traditional loan used to finance the purchase of a home and is what most people have in mind when they think about a mortgage. (For more insight, see )

Pros

Fixed-rate mortgages remain popular for a variety of reasons, the most obvious of which is that they enable buyers to spread out the cost of paying for an expensive purchase by making smaller, predictable payments over a long period of time. Because the interest rate does not change, homebuyers are protected from sudden and potentially significant increases in monthly mortgage payments if interest rates rise.

Another advantage of fixed-rate mortgages is that they are easy to understand. While some loan types include complicated payment schedules and shifting interest rates, fixed-rate mortgages are basic loans with much less complex payment schedules and stipulations. The loan's basic components, (the amount borrowed) and (the premium paid to the lender for granting the loan), are repaid in the form of monthly payments.

Once you know how much the monthly payment will be, you've got a pretty good overview of the loan's impact on your monthly finances. Most fixed-rate loans also permit borrowers to make extra payments in order to shorten the term of the loan or to make lump-sum payments to retire the loan early with no prepayment penalties.

Most fixed-rate mortgages can be categorized as "plain vanilla" financial products. While they are available in a variety of terms, including those that stretch payments out over anywhere between 10 and 50 years, there's nothing fancy or overly complicated about them.

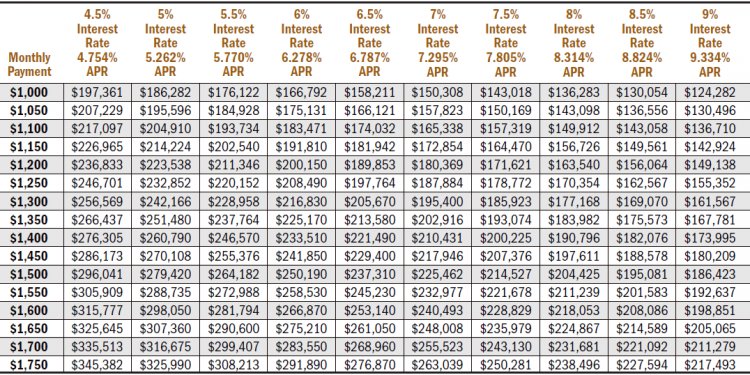

Longer-term loans come with smaller monthly payments but lead to higher interest rate costs over the life of the mortgage. Shorter-term loans are paid off more quickly, and incur less interest costs over the mortgage life, but have higher monthly payments. Similar loans vary little from lender to lender in terms of costs, interest rates, payments and other variables. (To learn more about the mortgage payment structure, see Paying Off Your Mortgage.)

Non-traditional versions of the fixed-rate mortgage offer the option to pay only the interest for a set period of years before making a one-time change to the payment schedule to incorporate the interest payments as well as repayment on the loan's principal. These loans are a fairly recent development. They enable homeowners to purchase expensive homes with relatively small payments during the initial period of time in which the interest-only portion of the loan is in effect.

While such an arrangement certainly results in a lower monthly payment during the first pre-arranged payment period, the upward adjustment when the principal comes due defeats the primary benefit of a choosing a fixed-rate loan in order to have predictable, unchanging payments over the lifetime of the loan. However, this option may be suitable for younger homebuyers as the lower, interest-only payments won't break the budget for those in entry level jobs. Furthermore, when the upward adjustment comes into effect years later, the homeowner's financial situation should have improved to handle the extra financial burden.

Cons

While fixed-rate mortgages are is the most popular loan choice for homeowners, there are a variety of reasons why fixed-rate mortgages aren't the right choice for everyone. One concern about fixed-rate mortgages is that qualifying for a loan is more difficult because the payments are less affordable than those offered by other types of loans. This situation is particularly acute when interest rates are high, although fixed-rate mortgages generally charge interest rates that are slightly higher than the rates available on other types of loans, even when interest rates are low.

Higher interest rates enable borrowers to get predictable payments, but they also reduce the amount of money that a would-be homeowner can qualify to borrow, thus limiting the price of homes that can be considered.

Another downside to fixed-rate mortgages is that, if interest rates fall, the interest rate on the loan doesn't change and neither does the monthly payment. In order to reduce the interest rate and the accompanying payment, you would need to the loan, which can be a costly endeavor. Even if you can afford to refinance, or are willing to refinance the fees associate with the new mortgage in addition to the actual amount of the mortgage itself, refinancing may cost more than it will save you in the long run.

The easiest way to determine whether refinancing is a financially viable choice involves calculating a simple payback period. This is accomplished by calculating the amount of savings that would be realized each month by refinancing into a new mortgage at a lower interest rate and determining the month in which that cumulative sum of monthly payment savings is greater than the costs of refinancing. (For more related reading on mortgage refinancing, please see: The True Economics Of Refinancing A Mortgage.)

When to Choose a Fixed-Rate Loan

Fixed-rate loans are generally the recommended option for people who have a steady source of predictable income and intend to own their homes for an extended period of time. The simplicity and predictability of fixed-rate mortgages make them a popular choice for first-time homebuyers.