Best fixed interest rate

CommonBond was founded by three Wharton MBAs who felt the sting of student loans after they graduated. The founders decided to provide a better solution for graduates, as they thought the student loan system was broken and in need of reform. As a result, they strive to make the refinance (and borrowing) process as simple and straightforward for graduates as possible.

CommonBond was founded by three Wharton MBAs who felt the sting of student loans after they graduated. The founders decided to provide a better solution for graduates, as they thought the student loan system was broken and in need of reform. As a result, they strive to make the refinance (and borrowing) process as simple and straightforward for graduates as possible.

CommonBond* began by servicing students from just one school, and has rapidly expanded. Today, CommonBond loans are available to graduates of over 2, 000 schools nationwide. Although the business started servicing only students with graduate degrees, today CommonBond is also available to refinance undergraduate degrees as well.

As you might be able to tell by the name, CommonBond thinks of its community as family. There is a network of alumni and professionals within the community that want to help borrowers. This alone sets it apart from other lenders, as members often meet for events.

While these are all great things, we know you’re more interested in how CommonBond might be able to help you make your student loans more affordable. Let’s take a look at what terms and rates they offer, eligibility requirements, and how they compare against other lenders.

Refinance Terms Offered

Refinance Terms Offered

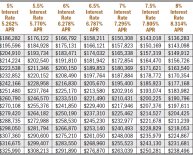

CommonBond offers low variable and fixed rate loans. Variable rates range from 2.23% – 6.03% APR, and fixed rates range from 3.50% – 7.74% APR.

Note that these rates take a 0.25% auto pay discount into consideration.

There is no maximum loan amount. CommonBond will lend what you can afford to repay. CommonBond offers fixed and variable rates with terms of 5, 10, 15, and 20 years.

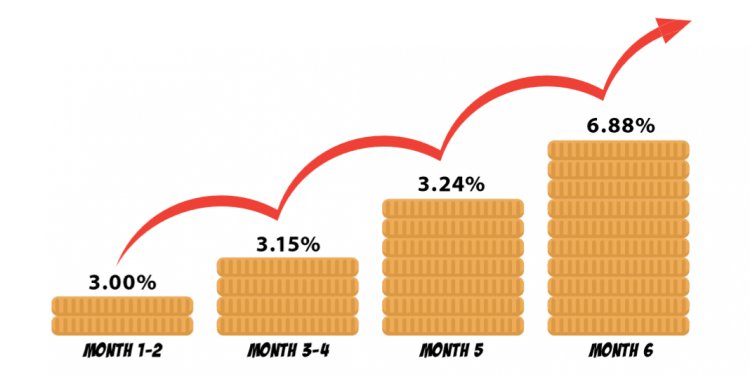

The hybrid loan is only offered on a 10 year term – the first 5 years will have a fixed rate, and the 5 years after that will have a variable rate.

To pull an example from that, if you borrow $10, 000 at a fixed 4.74% APR on a 10 year term, your monthly payment will be $104.80. The total amount you will pay over the 10 year period will be $12, 575.90.

The Pros and Cons

CommonBond is available to graduates of 2, 000 universities. While that is a very long list, not all colleges and universities are included.

One pro to consider is the hybrid loan option available. It might seem a little confusing at first – why would someone want a variable rate down the road?

If you’re confident you’ll be able to make extra payments on your loan and pay it off before the 5 years are up, you might be better off going with the hybrid option (if you can get a better interest rate on it).

This is because you’ll end up paying less over the life of the loan with a lower interest rate. If you were offered a 10 year loan with a fixed rate of 6.49% APR, and a hybrid loan with a beginning rate of 5.64%, the hybrid option would be the better deal if you’re intent on paying it off quickly.

What You Need to Qualify

CommonBond doesn’t list many eligibility requirements on its website, aside from the following:

- You must be a U.S. citizen or permanent resident

- You must have graduated

CommonBond doesn’t specify a minimum credit score needed, but based on the requirements of other lenders, we recommend having a score of 660+, though you should be aiming for 700+. The good news is CommonBond lets you apply with a cosigner in case your credit isn’t good enough.