Remortgage interest Rates

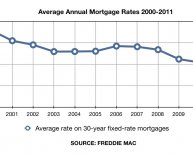

Interest rates may not rise until 2017 the Bank of England has suggested this month, but mortgage borrowers should still consider switching to a cheaper deal now, with rates near all-time lows.

Interest rates may not rise until 2017 the Bank of England has suggested this month, but mortgage borrowers should still consider switching to a cheaper deal now, with rates near all-time lows.

In recent months Bank Governor Mark Carney has hinted that an interest rate hike could come under consideration in early 2016. But the Bank confirmed interest rates would be held at their record low of 0.5% this month, and also suggested rates may not now rise until 2017.

The news will be well received by borrowers, as low interest rates tend to mean cheaper mortgage deals. But Ray Boulger, from broker John Charcol, says while there is "no need to rush into taking out a new fixed rate", equally "do not expect rates to get much cheaper".

He adds the initial market reaction to the Bank's announcement late last week was to push up gilt yields government-issued bonds the Bank buys and swap rates the rates at which banks lend to one another which he says "suggests there will be no initial downward push on mortgage rates specifically as a result of Mark Carney's comments".

Boulger says: "By waiting, you may or may not end up with a slightly cheaper deal, but the longer you wait, the longer it will take to claw back the higher rate paid whilst on your standard variable rate (SVR). Therefore, the message remains to arrange a new deal in time to avoid paying the SVR, and this applies even more so for borrowers whose lender's SVR is between 5% and 6%, which many are."

Get Our Free Money Tips Email!

For all the latest deals, guides and loopholes - join the 10m who get it. Don't miss out14 top tips to cut costs

To help you cut mortgage costs now, MoneySavingExpert.com founder Martin Lewis has compiled his 14 top tips below. And to inspire you to take action, here are some tweets we received when we covered this earlier in the year:

- Craig: "@MartinSLewis. Prompted by your email to remortgage. Saving 2, 400 over two years and no fees. #TopResult."

- Sarah: "Got a new rate with the same bank, saved 289 a month."

1. Check your current deal. Here's what you need to know about it.

1. Check your current deal. Here's what you need to know about it.

a. The current rate: And monthly repayment & amount outstanding.

b. Type: Is it a fix, tracker, discount or standard variable rate (SVR)?

c. Deal deadline: If it's a short-term deal (eg, 2yr fix), when it ends.

d. Term: How long it is, eg, 25yrs, and when it must be fully repaid by.

e. Penalties: Are there early repayment or exit penalties?

Crucially find your CURRENT loan-to-value (LTV) the proportion of the value you're borrowing, 80k on a 100k property is 80% LTV. For each 5% lower your LTV, until 60%, the cheaper the deal.

For all the latest deals, guides and loopholes - join the 10m who get it. Don't miss out2. FREE 60-page Remortgaging Booklet. A mortgage is most people's biggest expenditure, and just because you've done it once, doesn't mean it's the same this time around. Ensure you know what you're doing. My fully updated guide takes you through it step-by-step. As Katie kindly tweeted: "Fixed rates so low. Excellent #Remortgage Guide from @MoneySavingExp."

Remortgage help 5-min video: sometimes it's easier to watch than read. See my short remortgage help video.

Remortgage help 5-min video: sometimes it's easier to watch than read. See my short remortgage help video.

3. Benchmark your cheapest deal at speed. Rates are low, yet many factors affect your top deal. To find your cheapest we've our...

4. Are you on your lender's SVR? Beware, you can likely save especially if you're one of the circa 50% of mortgage holders on an SVR, the go-to-rate after a deal ends. Remortgage deals can be 3.15 percentage points cheaper saving 2, 900/yr on a 150k mortgage.

- HSBC 3.94%

- Lloyds, Halifax, Nationwide & Barclays 3.99%

- RBS 4%

- Santander & Coventry BS 4.74%

- Virgin Money 4.79%

- Yorkshire BS 4.99%

Not everyone on an SVR can save, for example, if the rate's decent some Lloyds & Nationwide customers who signed up years ago still pay 2.5%.

5. What deals could I get? The table below shows typical rates. I've added in the average SVR, for comparison.

| Example mortgage deals - costs based on 150k mortgage

|

||

| DEAL | RATE + FEE | ANNUAL COST DURING DEAL TERM (INCL FEE) (1) |

|---|---|---|

| Typical SVR rate | 4.3% | 9, 800 |

| 1.15% + 1, 995 | 7, 910 | |

| 1.82% + 1, 675 | 8, 315 | |

| 2.19% + 999 | 8, 300 | |

| 2.79% + 999 | 8, 840 | |

| 1.04% + 1, 675 | 7, 655 | |

| 1.74% + 975 | 7, 890 | |

| (1) Fee spread across deal period + repayments, assumes 25yr term. | ||

6. A tool to factor in fees to see each mortgage's true cost. The smaller your mortgage (especially if sub-100k), the bigger the impact of fees. To assess, spread fees over the fixed or tracker period (as after you may shift deal). To help, the MSE Total Cost Assessment in our best buys comparison factors in fee and rate for your cheapest.

7. Should I get a fix or tracker/discount? With a fix, the amount you repay is, er, fixed - it's insurance against possible rate rises. Variable deals move with UK interest rates (sometimes just at a provider's whim). Currently you only pay a touch more to fix.

We can't predict future interest rates, so focus on your finances - the more crucial the surety of knowing the cost, the more you should hedge towards fixing, and fixing longer. If a rock-bottom deal's your focus, hedge towards short-term trackers. See Fix vs Variable help.