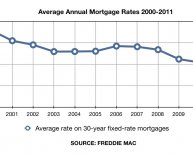

Cheap mortgage interest rates

Oil prices have been falling since the summer of 2014. For the average consumer, that’s obviously good news. Gas is selling for about .

Less obvious is the effect of cheap oil on your mortgage. Rates on home loans have been falling all year and probably will keep going down in the near term. A 30-year, fixed-rate mortgage averaged 3.72 percent last week.

Cheap oil is a driver of that cheap borrowing.

Source: Freddie Mac, U.S. Energy Information Administration

Why?

The global economy has been increasingly unsteady. There’s more than enough oil to go around because production is up and demand is down. Big consumers, like China, are slowing down. Big producers like Russia and Venezuela keep drilling, even with prices below $35 a barrel. There’s pain all around.

The ripple effect of slowing global growth has hit hard and caused unsettling swings in the stock market. Investors are seeking a safe shelter for their money to ride out the storm and they’re finding it in low-risk U.S. Treasuries, which are being snapped up.

When Treasuries are in demand, they get cheaper. And when Treasuries get cheaper, U.S. mortgages usually do, too. That’s what’s happening now.

“Cheap oil also adds to low inflation, priming the pump for an economic environment where low interest rates can be maintained, ” Redfin chief economist Nela Richardson said.

Great! For Now

Everyone loves cheap loans and gas, but neither are guaranteed in the long run. Today, Fed Chair called the global economic outlook “uncertain.”

“Foreign economic developments, in particular, pose risks to U.S. economic growth, ” Yellen told the House Financial Services Committee. Cheap oil is bringing pressure to bear on vulnerable exporting countries, which eventually could affect the economy here, she said. “Foreign activity and demand for U.S. exports could weaken and financial market conditions could tighten further.”