Conventional mortgage interest rates

FHA vs Conventional

The FHA vs Conventional is a choice for home buyers between getting access to the lowest mortgage rate possible, or the lowest down payment possible. In general, buyers with average credit scores or lower will be better suited to an FHA loan because FHA mortgage rates don't increase for borrowers with low credit scores like conventional mortgage rates do. However, FHA mortgage insurance premiums last for the life of the loan, so buyers planning to stay eight years or more may want to opt for a conventional loan, irrespective of credit score.

Low-Downpayment Mortgage Options

Recently, mortgage lenders reduced minimum credit score requirements for the FHA's popular 3.5% downpayment loan; and, two 3% down payment programs have been retooled - the Conventional 97 and the Fannie Mae MyCommunity Mortgage (which is now known as HomeReady™).

Add to these two programs the 100% VA loan backed by the Department of Veterans Affairs and the no-money-down, "rural housing" loan from the U.S. Department of Agriculture (USDA), and you'll find today's home buyers with no shortage of low- and no-downpayment home loan options.

For many buyers, though, the choice among low-downpayment loans will be between the FHA loan and the Conventional 97. This is because VA loans are available to military borrowers only; USDA loans are restricted to suburban and rural areas, with maximum income limits; and HomeReady™ has similar income restrictions.

So, which is the better mortgage: the FHA loan or the Conventional 97?

About The FHA 3.5% Downpayment Program

The Federal Housing Administration (FHA) is not a lender. Rather, it's a loan insurer. The federal agency was established in 1934 and exists to support homeownership within communities.

The FHA played a crucial role in the post-depression housing market.

In the 1930s, it was difficult to get a home loan. Loan terms were for five years or less, which meant that loans were required to be "paid off" in 60 months or fewer; minimum downpayment amounts was set at 50% of the purchase price; and, homeowners were afforded little protection from cash-strapped banks which may have been forced to foreclose just to keep a strong balance sheet.

Then came the FHA.

Promising affordable and stable financing, the FHA established a program by which it would insure U.S. lenders against losses on a loan and provide more favorable loan terms for U.S. borrowers.

More than 80 years later, the FHA continues to fulfill its role.

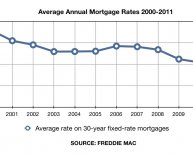

Today's FHA homeowners get access to loans of up to 30 years; minimum downpayment requirements are as low as 3.5%; and, FHA mortgage rates routinely beat the market average - often by a quarter-percentage point or more.

In order to get the FHA's backing, banks must only verify that loans meet minimum FHA lending standards, a collection of rules which are more commonly known as the "FHA mortgage guidelines".

FHA mortgage guidelines state that eligible home buyers must have documented, verifiable income, for example; and require home buyers to live in the home being purchased.

The FHA also requires home buyers to pay mortgage insurance premiums (MIP) as part of their monthly payments.

FHA MIP varies by loan type and downpayment, with the most common scenario being a home buyer using a 30-year fixed-rate FHA loan with the minimum allowable 3.5% downpayment; and paying 0.85 percent against the borrowed amount in mortgage insurance premiums annually, or $71 per month per $100, 000 borrowed.

The FHA cancels FHA MIP after 11 years for loans which started at 90 percent loan-to-value (LTV) or lower. For everyone else, FHA MIP must be paid until the loan is paid-in-full or refinanced into a non-FHA loan.

The FHA is the largest insurer of mortgages in the world. It currently insures close to 1-in-4 new U.S. mortgages.

About The Conventional 97 LTV Program

The Conventional 97 loan is another low-downpayment option available to today's mortgage borrowers.

Available via Fannie Mae and Freddie Mac, the program was recently re-tooled to be cheaper and easier to use.

For example, as compared to the original Conventional 97, the newest version is available to first-time buyers and repeat buyers alike, where "first-time buyer" is defined as a person who has not owned a home in the last three years.

This definition of first-time buyer means that consumers who lost a home to foreclosure last decade can be Conventional 97-eligible under the program's new rules.

Furthermore, because Conventional 97 allows for cash gifts for downpayments, home buyers are not required to make a downpayment from their own funds. Monies may be 100% gifted from parents and relatives. The only requirement is that the gift is actually a gift - downpayment "loans" are disallowed.

For eligible borrowers, the rules of the Conventional 97 program are straight-forward.

The Conventional 97 program requires a minimum downpayment of 3%, only 30-year fixed rate mortgages are allowed, and the loan must be used for a primary residence.

Beyond that, there is very little to distinguish a Conventional 97 loan from any other conventional mortgage type. Borrowers are required to verify income and employment; the program can be used to refinance a home; and, home buyer counseling is not required.

With all Conventional 97 loans, though, PMI cancels when the loan reaches 80% LTV. That is, when the homeowner has 20% equity in its home.

Which Is Better: FHA Or Conventional 97?

There are a multitude of low-downpayment options for today's home buyers but many will choose between the FHA 3.5% downpayment program and the Conventional 97.

So, which loan is better? That will depend on your circumstance.

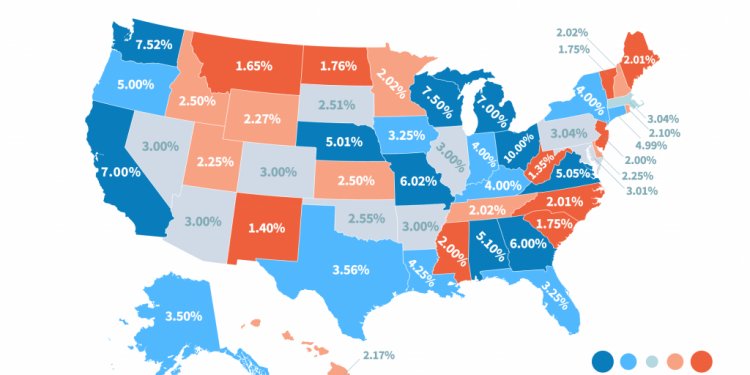

For example, in deciding between an FHA loan and the Conventional 97, your individual credit score matters. This is because your credit score determines whether you're program-eligible; and, it affects your monthly mortgage payment, too.

FHA loans are available with credit scores of 580 or better. The Conventional 97 loan, by contrast, requires a minimum credit score of 620.

Therefore, if your credit score is between 580 and 620, the FHA loan is best for you because it's your only available option.

As your credit score increases, though, the Conventional 97 gets more attractive. Your mortgage rate drops and your PMI costs do, too. This is different from how FHA loans work.

With an FHA loan, your mortgage rate and MIP cost is the same no matter what your FICO score.

Therefore, over the long-term. borrowers with above-average credit score will typically find Conventional 97 loans more economical relative to FHA ones.

In the short-term, though, FHA loans win.

Assuming a loan size of $250, 000 and today's mortgage rates, FHA loans are 10% cheaper for borrowers with "excellent" credit scores. For borrowers with weak credit, they're 26% cheaper. But, this doesn't mean FHA loans are best.