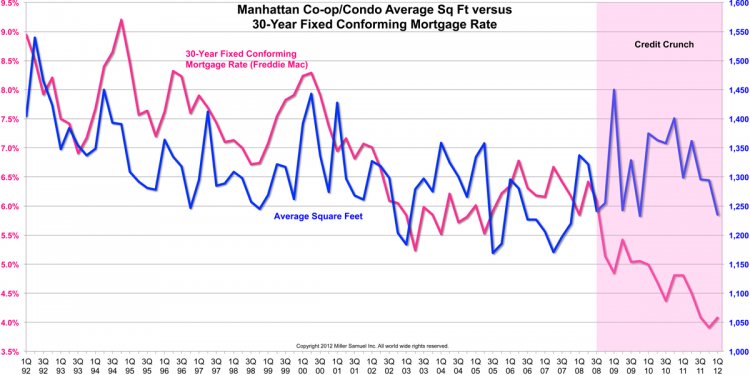

30 Yr Conforming Fixed

Jumbo mortgages are giving traditional 30-year fixed mortgages a run for your money.

Jumbo mortgages are giving traditional 30-year fixed mortgages a run for your money.

Over the past year, the 30-year fixed mortgage rate has been above the jumbo mortgage rate during 40 weeks. In only 11 weeks was the jumbo mortgage rate higher, according to Bankrate research. (They were equal during one week.)

It's not supposed to be that way. The jumbo mortgage is supposed to come with a slightly higher rate.

What is a jumbo mortgage?

A jumbo loan is a mortgage for more than the conforming limit set by Fannie Mae and Freddie Mac, 2 government-sponsored agencies that buy mortgages from lenders.

In most U.S. counties, any mortgage of more than $417, 000 is a jumbo loan. In U.S. counties with high home prices, the conforming limit is higher - up to $625, 500. In other places, the limit is in between.

The underwriting process for jumbo mortgages is similar to that of a conforming mortgage, except that jumbo lenders sometimes require 2 appraisals instead of just 1.

Down payment requirements differ in many cases. Jumbo loans generally require higher down payments. Depending on the lender, the minimum down payment could be 15%, 20% or 30% for home purchases.

Higher credit score required

Many lenders require a credit score of 700 or higher, a debt-to-income ratio of 43% or less, and 6 to 12 months' worth of reserves.

That's one of the reasons that rates for jumbo mortgages are lower than rates on traditional mortgages.

Large banks like to hold jumbo mortgages on their balance sheets. "The credit quality of the jumbo asset is so pristine that they are considered to be insulated from any credit issues, " says Matt Hackett, operations manager for Equity Now, a direct mortgage lender.

There are also far fewer borrowers who can qualify for a jumbo loan, so supply is scarce. "Banks are competing for the product and driving rates down near or sometimes below conforming loan rates, " Hackett says.

Michael Chadwick, a CFP professional with Chadwick Financial Advisors, says banks might offer lower rates to get high-end consumers in the door.

"They're actually a safer bet, they save their money, have more of it, have assets and behaviors that don't endanger a bank's position, " Chadwick says. "They also offer banks the opportunity to cross-sell the more affluent consumer a host of their products and services."

Real estate news you don't want to miss

Pending home sales grew in most of the U.S. in July and reached their second-highest mark in more than a decade, according to the National Association of Realtors. Only the Midwest saw a dip in contract activity last month.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, rose 1.3% to 111.3 in July from a downward-revised 109.9 in June and is now 1.4% higher than July 2015 (109.8). The index is now at its second-highest score this year, behind April (115).

The Pending Home Sales Index, a forward-looking indicator based on contract signings, rose 1.3% to 111.3 in July from a downward-revised 109.9 in June and is now 1.4% higher than July 2015 (109.8). The index is now at its second-highest score this year, behind April (115).

Listing of the week

Property: 4808 Rose Rock Drive

Square footage: 9, 943

Asking price: , 575, 000

You would think being near a major outdoor music venue would be a disaster for home prices.

One of those venues was the OKC Zoo Amphitheater in Oklahoma City where homes are 68% more expensive than the surrounding ZIP code.

The OKC property has a lot to offer on its own, but it does make note in its description that it's a short walk to the city zoo and Lincoln Park Golf Course, near the amphitheater.

Mortgage rates this week

The average 30-year fixed rate mortgage held steady at 3.57%. Sure, this is still a good time to refinance. If you're interested in a 15-year mortgage, the average rate dropped 1 basis point to 2.86%. A basis point is one-hundredth of 1%.

Pop quiz question:

What is the best-selling car of all time? Scroll to the bottom for the answer.

Tweet of the week

The #housing crisis may have killed the "McMansion" for good, says @MadelineLStone

— Ilyce Glink (@Glink)

RTI comment of the week

This week's top comment comes from Brett Sinnott, vice president of capital markets at CMG Financial in San Ramon, California. He predicted rates would be unchanged week over week.

"Markets have been extremely quiet over the past several weeks and mortgage rates have hovered in the current range for most of the summer. This may change in September as the Fed has indicated that another strong jobs report would give them reason to increase rates.

"Many believe that this is their last window to do so this year, and that their credibility may be the biggest determining factor. The rate increase in 2015 actually helped mortgage rates, but borrowers may not be so lucky this time around, and anyone pondering a decision should act sooner than later on their mortgage transaction."